2018 schedule c car and truck expenses worksheet. 31 car and truck expenses worksheet.

New Fleet Management Excel Spreadsheet Free xlstemplate

Make sure to track these expenses regularly, always saving and organizing receipts.

Schedule c car and truck expenses worksheet cost. In the additional 1040 vehicle information group box, click the optimize, standard mileage, or actual costs tax treatment option and enter expenses in the applicable fields. Follow the first four steps we used previously but this time add the format command. To use the standard mileage rate, go to the car and truck expenses section of the schedule c and enter your information.

Free download schedule c expenses worksheet, business expense spreadsheet template free, tax spreadsheet for small business, small business expense worksheet, schedule c expenses spreadsheet, self employed monthly expense worksheet, schedule c car and truck expenses worksheet instructions, When you figure this deduction, your first decision is whether to. Deduct car and truck expenses on line 9 of schedule c.

Name & type of business: Schedule c part ii expenses line 9 car and truck expenses is including the property tax entered on line 25b of the cartruck worksheet and i am claiming the standard mileage rate. There are two methods you can use to deduct your vehicles expenses, standard mileage rate or actual car expenses.

There are an empty box next to the question and i need to enter a number before i can file my tax return. Cost must be entered. hi everyone, i almost complete my tax return but at the end the program asked me to entered my vehicle cost. Learn about schedule c categories and how to categorize transactions in quickbooks.

Below is a list of schedule c expenses and a brief description of each: Ultratax cs defaults to the optimize tax treatment only in the first year the vehicle is placed in service, but you can select actual costs or standard mileage to force a different tax treatment. With the mileage rate you wont be able to claim any actual car expenses for the year.

You may only use one method per vehicle. You can use your actual expenses, which include parking fees and tolls, vehicle registration fees, personal property tax on the vehicle, lease and rental expenses, insurance, fuel and gasoline, repairs including oil changes, tires, and other routine maintenance, and depreciation. The expenses section of the schedule c includes common costs like advertising, utilities, rent, car expenses, and insurance.

Truck driver tax deductions worksheet schedule c car and truck car and truck expense worksheet general info vehicle 1 vehicle 2 must have to claim standard mileage rate dates used if not for the time period description of vehicle date placed in service total business miles total commuting miles other miles total miles for the period purchased or leased vehicle information. Adhere to the instructions about what to edit. Continue following steps 5 through 7 8.

Use separate sheet for each business. You have two options for deducting car and truck expenses. Business name employer id number professional product or service business address, city, state, zip this business started or was acquired during _____ yes no payments of $600 or more were paid to an individual who is not your employee for services provided for this.

Cost of those goods and services in the relevant expense categories. Enter the same description and date placed in service as appeared on the 4562 screen. From the bottom of the list choose format comment 10.

Schedule c (form 1040) 2018. Also use schedule c to report a wages and expenses you had as a statutory employee b income and deductions of certain qualified joint ventures and c certain income shown on form 1099 misc miscellaneous income. You may maintain written evidence by using an electronic storage system that meets certain requirements.

The best car truck expenses worksheet schedule c exterior and car truck expenses worksheet information submitted by vehicle 1 vehicle 2 vehicle 3 make model of vehicle date placed in business use if truck please list 12 34 or 1 ton odometer reading as of 12 31 17 odometer reading as of 01 01 17 total miles for the year business miles for the. Car & truck expenses worksheet: If you have a choice of methods, the program compares the vehicle expenses using both methods, and selects the method giving the larger deduction.

It's also known as form 1040. Use a separate worksheet for each business owned/operated. On the auto screen for this vehicle, first select to which form or schedule the vehicle belongs and enter the corresponding mfc for that schedule.

Click on the colors and lines tab if you only have a. The car and truck expenses worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate or the actual expense method. If you use your car or truck in your business you can deduct the.

Even though schedule c only has to be filed with annual taxes, its good practice to fill one out for quarterly taxes too. Car and truck expenses o you may deduct car/truck expenses for local or extended business travel,. Click the format button on the qat 9.

To use the standard mileage rate, go to the car and truck expenses section of the schedule c and enter your information.

037 Vehicle Maintenance Schedule Template Fleet Management

How to organize your taxes with a printable tax planner

Automotive Wolf Car Care Software Car

Unique Construction Project Schedule Template

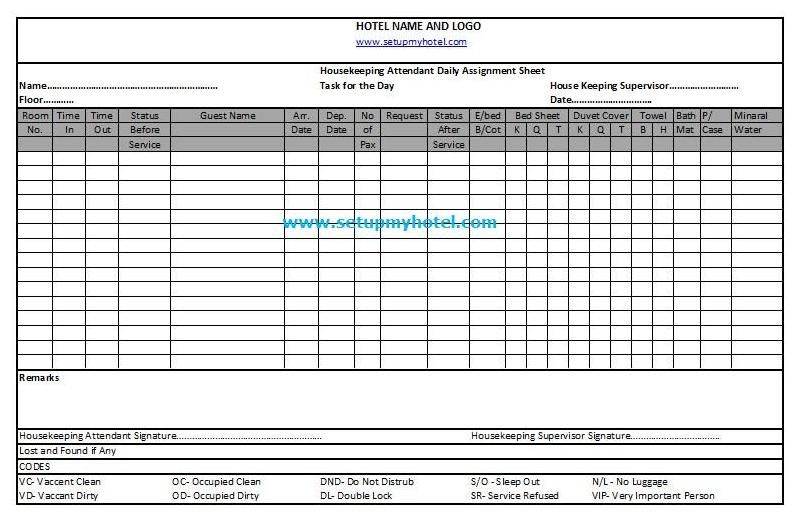

Room Attendant Sheet Sign in sheet template

Preventive Maintenance Schedule Template Excel Best Of

Budget Spreadsheet Download Car

bank examples flowchart Microsoft Powerpoint Flowchart

Fleet Maintenance Spreadsheet Template in 2020

Get House Cleaning Schedule Template XLS Clean house

What Your Itemized Deductions On Schedule A Will Look Like

Tax Guide Real Estate Agents Side 2 Tax guide, Real

Pin by Sassy Turtle Designs on Finances Excel

Facility Maintenance Plan Template Elegant 4 Facility

equipment maintenance log template at http//www

Procurement Savings Spreadsheet Spreadsheets offered us